Choosing the best pet insurance might be a bit of a task, so we wrote down the most important things that you should know before making a decision. In this article you’ll also find a comprehensive table of different pet insurance providers, their coverage plans, costs and more.

Table of Contents

- How Does Pet Insurance Work?

- Is Pet Insurance Worth It?

- How Much is Pet Insurance?

- How to Choose the Best Pet Insurance

- Is There a Pet Insurance That Covers Everything?

How Does Pet Insurance Work?

Pet insurance covers your Doodle’s medical costs for unexpected illnesses and injuries. When you enroll for pet insurance, you get to choose the best pet insurance plan tailored for you and your furry family member.

So, how does it work exactly?

First, you’ll have to decide on your annual or per-incident deductible based on what options the insurance company offers. In other words, first choose the amount of money you’ll pay toward your vet bills.

Second, you need to decide on the reimbursement level. This is a percentage of the medical cost that the insurance company will cover.

Some insurance companies have set a maximum allowance of what they will pay for medical bills annually. Read the terms carefully!

Does Every Vet Take Pet Insurance?

Usually, a pet insurance company will reimburse you a portion of the cost after you’ve paid the vet bill. In contrast, some insurance companies do offer the option to handle it directly with your vet.

Nevertheless, keep in mind that insurance companies only pay for medical bills charged by licensed veterinarians. Typically, you can choose your own vet, but they will need to have a license to practice.

Is Pet Insurance Worth It?

Based on everything I have heard, I feel that we should get pet insurance for our 11-month-old [Doodle] (my first/only pet as an adult). However, my husband (who has had dogs his whole life but never used insurance) doesn’t necessarily agree, at least not at this point in our dog’s life. We are trying to determine whether to dive in or not. Can I please hear your advice/thoughts?

Is it worth getting pet insurance for dogs? To put it simply, yes. Pet insurance is absolutely worth it. And we recommend that you insure your Doodle as soon as possible. Vet visits, medical care and surgeries can cost thousands of dollars. Thus, you might be able to save a lot of money in the long run.

It’s wise to start with pet insurance before any health problems or hereditary conditions start to appear. Furthermore, most dogs will encounter some kind of health issues later on in life.

As with all dog breeds, Doodles are also prone to certain hereditary conditions.

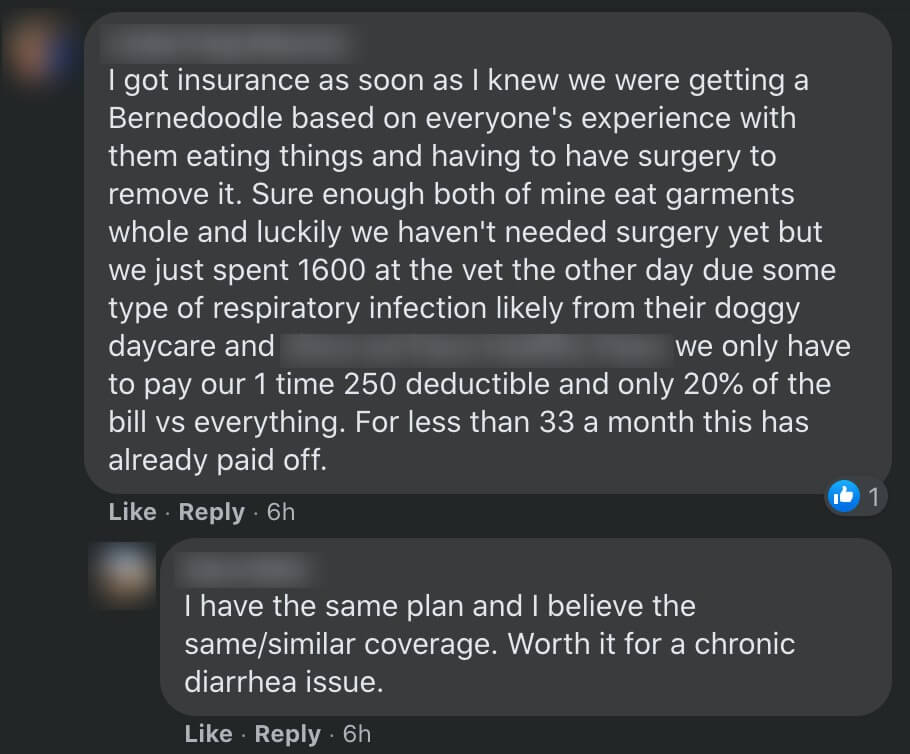

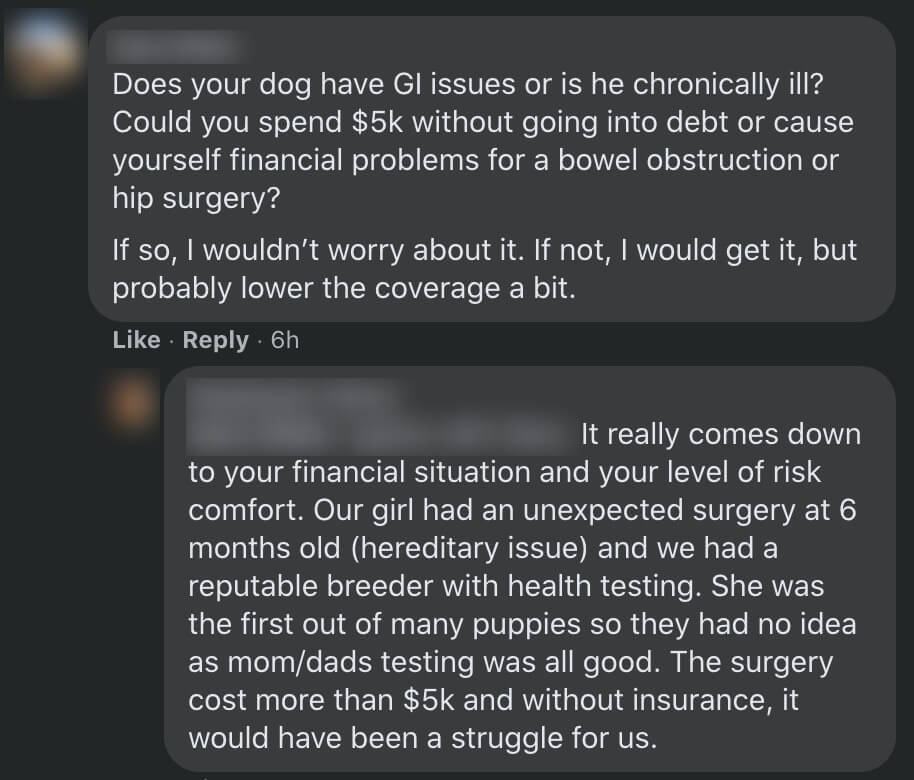

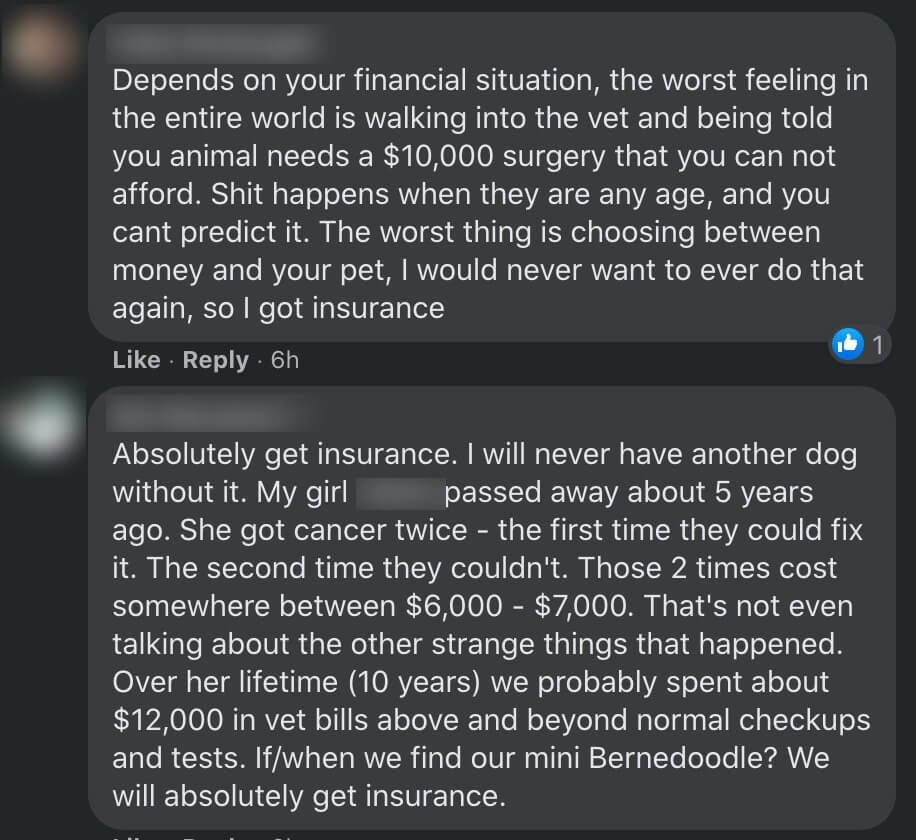

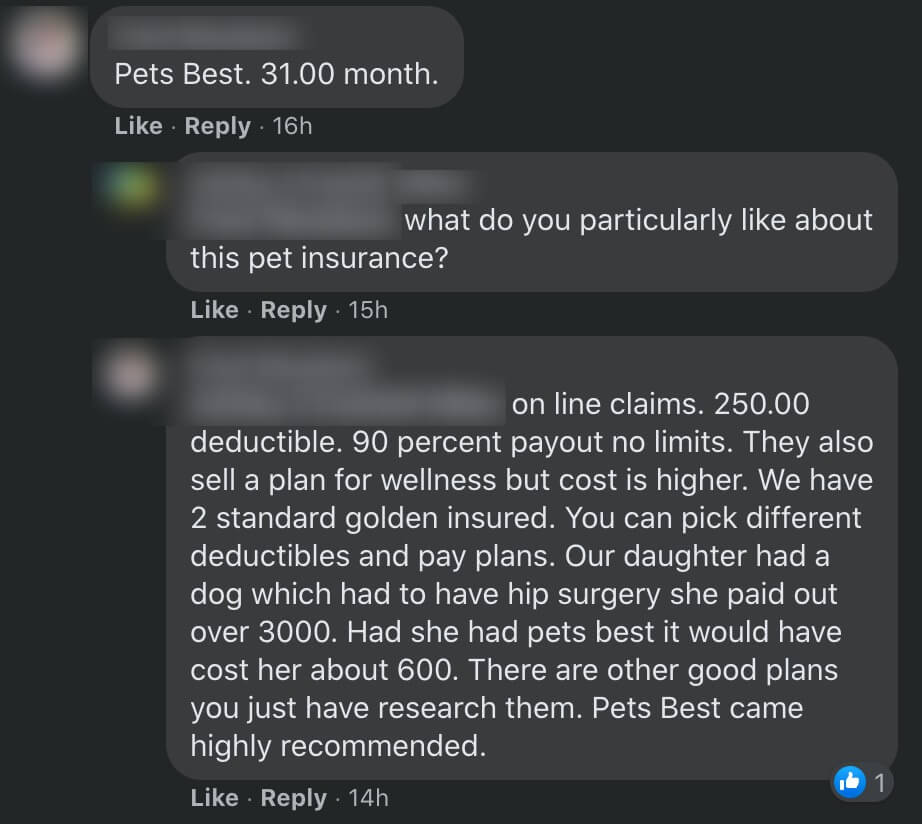

Here’s what other Doodle owners had to say about getting pet insurance:

How Much is Pet Insurance?

Pet insurance rates are determined by many different factors. Namely: pet species, breed, age, insurance coverage, your chosen deductible and reimbursement levels, and also your location.

So what is the average cost of pet insurance per month? Generally, the cost per month to insure your Doodle can vary from $10-$100. The average cost is usually in the $40-$70/mo. range.

How to Choose the Best Pet Insurance

Choosing pet insurance requires a fair bit of research. You should learn the different types of pet insurances and what each of them offers. To make things a bit easier for you, we’ll go over the most common types of pet insurances and their coverage and reimbursement plans.

What Does Pet Insurance Cover?

Above all, pet insurance is designed to help you with the costs of medical care that’s needed for unexpected incidents. On the other hand, pet insurance companies do offer different types of coverage for various vet services. However, not all of them are included in basic insurance plans!

It’s crucial that you study the company insurance policy very carefully to avoid any unexpected vet costs.

Pre-Existing Pet Insurance

Unfortunately, pet insurances do not cover pre-existing conditions. For instance, if your dog has suffered a health problem before enrolling for pet insurance, the costs for this won’t be covered. Or, if your Doodle gets injured during the waiting period.

However, most insurance companies set a time limit, which determines if the issue is still considered a pre-existing condition or not. For example, if your Doodle has not had any symptoms and treatments for the pre-existing condition for one year, it may be covered by insurance afterwards.

Incurable pre-existing conditions aren’t covered.

If your Doodle does have a curable pre-existing condition, look for insurance plans that have the shortest time limit for these cases. Some insurance companies will cover the medical costs of the condition if the symptoms have not re-appeared and needed treatment in the last 12 months. For some companies, it is 180 days.

Emergency Pet Insurance

In case of an immediate, critical emergency, this option covers a portion of the ER and urgent care medical costs. This can include examinations, lab tests, surgery, and more.

In case you’re worried about critical emergencies, you should opt for a pet insurance plan that covers pet ER care and all the necessary services like X-ray or surgery.

Preventive Care Pet Insurance

Preventive care includes vaccines, heartworm prevention, dental cleanings, and other necessary routine actions that are needed to keep your Doodle healthy and to prevent illnesses.

Already have insurance for your Doodle? Ask about preventive care plans that your insurance company provides. They might have discounts in place for multiple plans. Thus, you’ll be able to save some money.

Routine Care Pet Insurance

Similar to preventive care pet insurance, routine care covers regular vet visits, teeth cleaning, spaying and neutering, vaccines, parasite treatment, and more.

Accident-Only Pet Insurance

This is the cheapest insurance policy that companies offer. It covers only accidents and not illnesses.

Specialist Pet Insurance

Specialist pet insurance covers medical costs toward different types of speciality care. It can include rehabilitation, physical therapy, orthopedic care, ophthalmologists, radiologists, internal veterinarians, but also pet ER hospitals.

Is There a Pet Insurance That Covers Everything?

Basic insurance plans do not cover everything we discussed above. Rather, they provide additional packages that you can choose to build the best pet insurance plan tailored just for your needs.

But keep in mind, the more additional plans you need, the more expensive it will be.

Wellness Pet Insurance

It’s important we stress that wellness pet insurance is not the same as regular pet insurance. Likewise, regular pet insurance usually does not cover wellness.

Wellness plans generally cover routine checkups and grooming costs. It can also be called preventive care pet insurance or routine care pet insurance.

These may include regular wellness exams, spray and neuter surgeries, grooming, nail trimming, teeth cleaning, nutritional supplements, and pest preventatives for ticks and fleas.

Are Pet Wellness Plans Worth It?

It truly depends on how much maintenance your Doodle needs and what health conditions your Doodle is prone to. If your Doodle needs frequent care like teeth cleaning and grooming, it might be reasonable to look into wellness plans.

Banfield Wellness Plan

Widely available across the US, Banfield Pet Hospitals offer different types of wellness plans that focus on prevention and annual routine care. Their biggest, special care package includes two comprehensive physical exams a year, diagnostic testing, vaccinations, fecal exams, de-worming, dental cleaning, urine testing, preventive X-rays, eye pressure test, electrocardiograms, and unlimited office visits.

Banfield Wellness Plan vs Pet Insurance

As we have already established, wellness plans are different from regular pet insurance. If you have a Banfield wellness plan, it can be extremely helpful in catching early signs of illness. However, it will not cover any emergency medical care for your Doodle.

Banfield wellness plans are only limited to Banfield hospitals. This is probably one of the biggest differences between Banfield wellness plans and regular insurance.

What is the Best Affordable Pet Insurance?

As we mentioned earlier, the cost of pet insurance is determined by a variety of factors. Your location, your Doodle’s breed, age, gender, and general health. Of course, going with an accident-only plan is generally the cheapest option out there.

But when choosing the best pet insurance, the cheapest might not be the best option. Have a close look at the conditions and terms, and ask as many questions as you need.

Best Pet Insurance: Comparison Chart

| Insurer | Cost Per Month | Coverage | Deductible | Pet Age Limit |

| Fetch by The Dodo Get a Quote Save up to 10% every month for life! | Starting from $10 to $100. Depends on your dog’s age, breed, your location, annual coverage, reimbursement and deductible. | Reimburse up to 90% of the vet bill. | Annual deductible options from $200-$2500. | No upper age limit. |

| Embrace Pet Insurance Get a Quote | Depends on breed, zip code, age of pet, choice of deductible, reimbursement percentage and annual maximum. In addition, Embrace has a $25 enrollment fee and $1 monthly processing fee if you pay monthly. Visit their website for a free quote. | Reimburse up to 90% of unexpected vet bills. | Offers annual deductible options. Each year your dog doesn’t receive a reimbursement, the deductible will be reduced by $50 and can go as low as $0. | Up to the age of 14 at enrollment. For older pets, you can purchase their accident-only plan. |

| MetLife Pet Insurance Get a Quote | Rates start from $12 and depend on your chosen plan. | Reimburse up to 90% of the vet bill. | Offers a $50-$500 deductible based on your chosen plan. | No upper age limit. |

| Healthy Paws Pet Insurance Visit Website | $20-$90, depending on breed, zip code, age of pet and choice reimbursement and deductible. | Reimburse up to 90% of unexpected vet bills, depending on your chosen plan. | Healthy Paws offers annual deductible options starting from $100, which depend on your dog’s age. | Must be under 14 years of age at enrollment. |

| ASPCA Pet Insurance Visit Website | Offers different rates that start from $16 and depending on breed, zip code, age of pet and choice of deductible. | Reimburse up to 90% of unexpected vet bills. | ASPCA offers annual deductible options starting from $100. | No upper age limit. |

| Figo Pet Insurance Visit Website | $9-$135 and depending on your plan. | Reimburse up to 100% of the unexpected vet bills. | Annual deductibles start from $100 and depend on your dog’s age and location. | No upper age limit. |

| Trupanion Pet Insurance Visit Website | $36-$100, depending on breed, pet’s age at enrollment, your chosen deductible and location. | Reimburse 90% of unexpected vet bills after you meet your deductible. | Offers a $0-$1000 deductible depending on your chosen plan. | Must be under 14 years of age at enrollment. |

| Nationwide Pet Insurance Visit Website | Rates start from $12. | Reimburses up to 90% of unexpected vet bills with Whole Pet with Wellness plan. | Annual deductibles from $100-$1000, depending on your chosen plan. | No upper age limit for their Whole Pet with Wellness plan. For other plans, a dog must be under 10 years of age. |

| Geico Pet Insurance Visit Website | Some plans start as low as $1 a day, but the rates depend on your dog’s breed, gender, age and location. | Reimburse up to 90% of the vet bill. | Different options that you can set. | Must be under 15 years of age at enrollment. |

| Progressive Pet Insurance Visit Website | Starting from $9 for accident only plans, and from $30 for other plans. The rates depend on your chosen plan, your dog’s breed, age, deductible and reimbursement level, your location and pre-existing conditions. | Reimburse up to 90% of the vet bill. | Annual deductibles from $50-$1000. | No upper age limit. |

| AKC Pet Insurance Visit Website | Between $10-$60, depending on your chosen plan. | Reimburse up to 90% after you’ve met your deductible and it’s based on your chosen plan. | Annual deductible options from $50-$1000. | No upper age limit. |

| State Farm Pet Insurance Visit Website | $25-$100, depending on breed, age, gender, location and your chosen deductible. | Reimburse 90% of unexpected vet bills. | Offers a $0-$1000 deductible depending on your chosen plan. | Must be under 14 years of age at enrollment. |

| Allstate Pet Insurance Visit Website | Average rate is $39, but it depends on your dog’s breed, age, your chosen plan, deductible and coverage limits. | Varies. You should contact your local Allstate agent to explore the options. | Varies. You should contact your local Allstate agent to explore the options. | Must be under 14 years of age at enrollment. |

| Hartville Pet Insurance Visit Website | Rates start from $10 and depend on your dog’s breed, age, location, reimbursement and annual deductible. | Reimburse up to 90% of the vet bill. | Annual deductible options from $100-$500. | No upper age limit. |

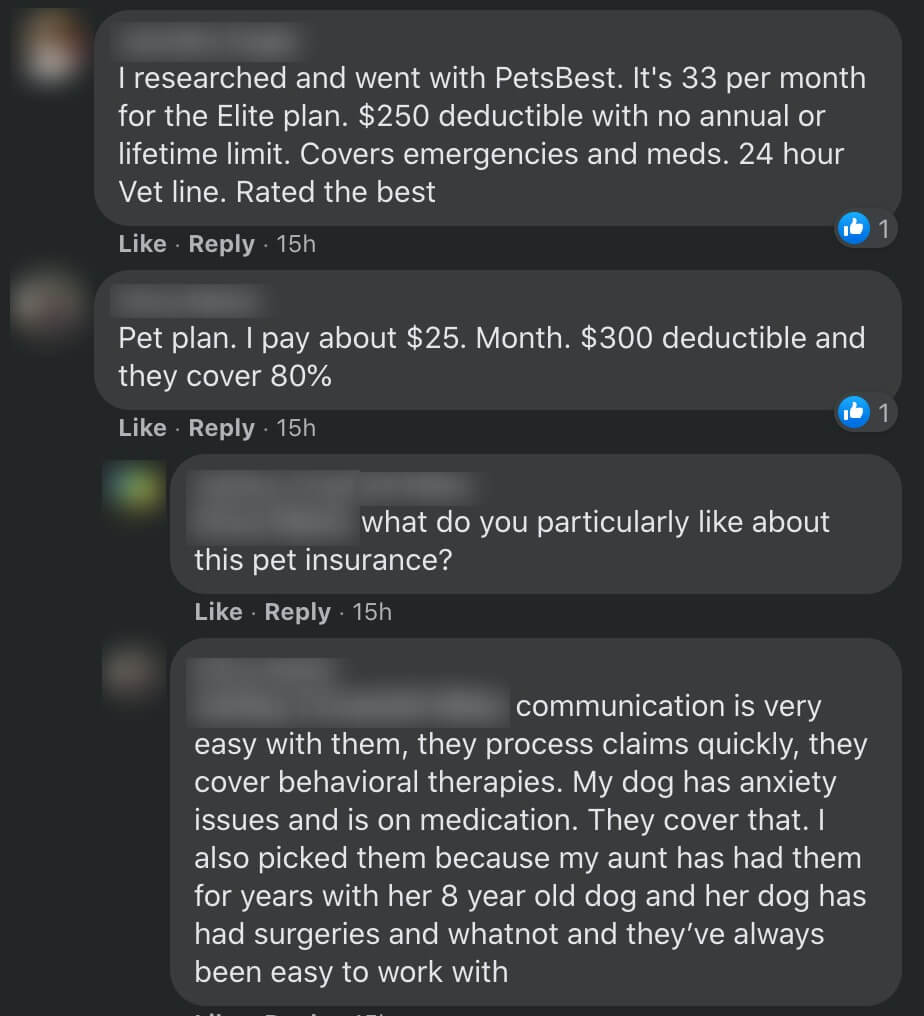

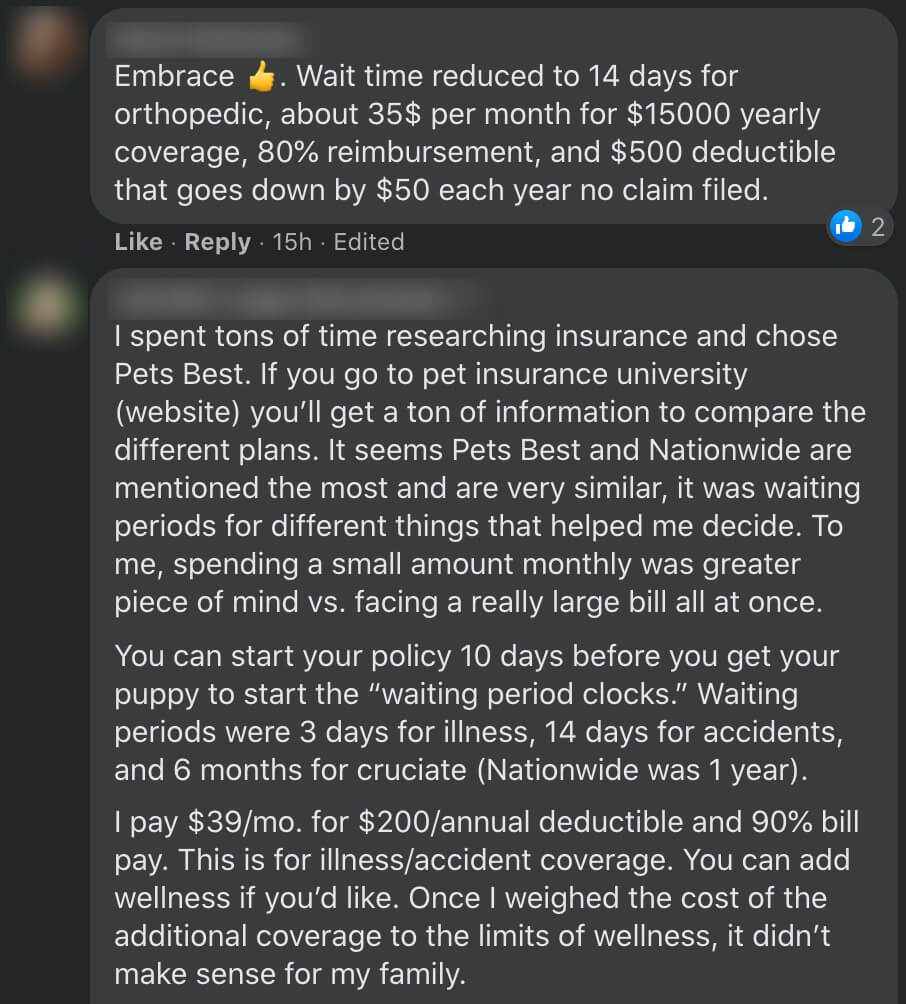

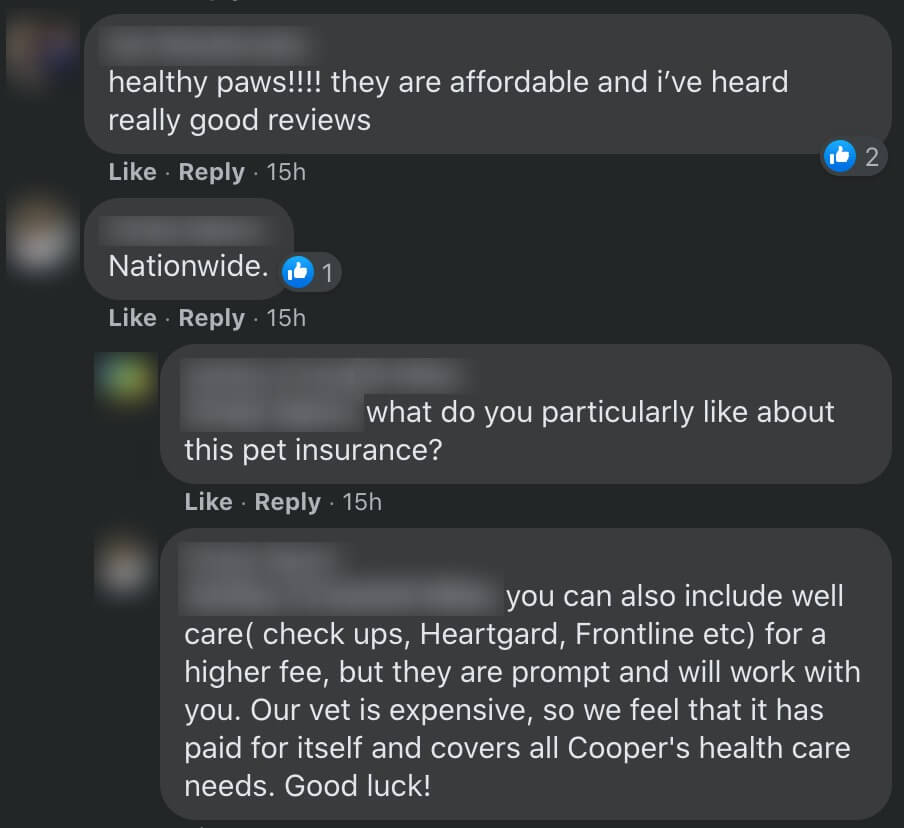

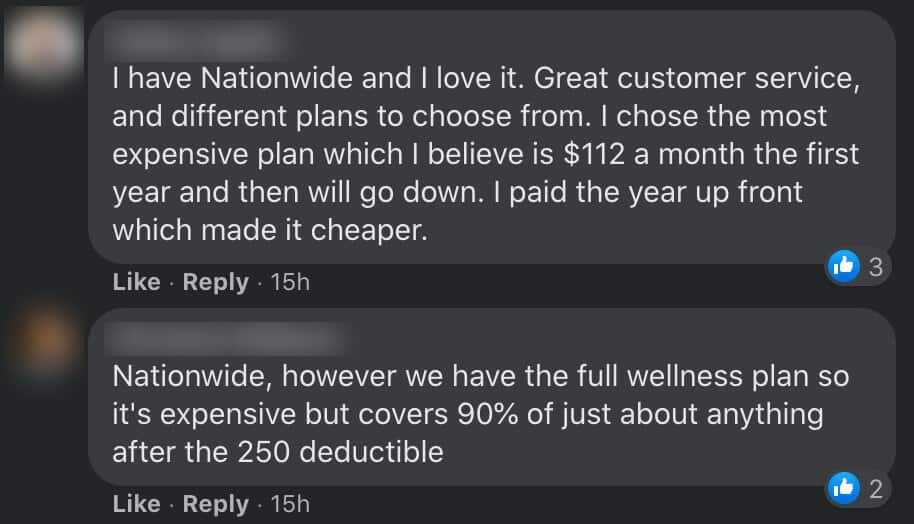

Pet Insurance Reviews From Doodle Owners

If you are pleased with your pet insurance, please tell me who it is with, why you like it and how much it is.

Click on an image to view fully sized:

In conclusion, we completely understand that choosing an insurance company is not the easiest of tasks. There are so many options out there with different plans and packages. When making your decision, it all comes down to the fine print. Carefully read each and every single thing that will be covered in the insurance plan.

Also, we recommend you read pet insurance reviews online to determine if an insurance company is trustworthy and helpful. Emergencies and health issues are a sensitive topic, so we imagine you’d only want to deal with a company who actually cares.

What has your experience been with pet insurance? Weigh in by leaving a comment below.

Attributions:

Pin it Image by Joab Woodger-Smith, used under CC BY 2.0 / Enhanced from original

The information on this page is for informational purposes only. It is not intended to be a substitute for qualified professional veterinary advice, diagnosis, or treatment. Always seek the advice of your veterinarian or other qualified animal health provider with any questions you may have.

We have had a really good experience with a combo plan for our 3 doodles with Wagmo. Wellness + insurance. Deductible is a bit higher, but we had the option to go with a lower option, just weighed it and figured we could handle the $1000. Claims handling is SUPER easy, payouts have been fairly quick. Overall I’ve been impressed.

September 6, 2023 at 8:46 am